Selling Commercial Investment Properties: Tips and Tricks

When it comes to selling commercial investment properties, providing comprehensive details is essential for engaging your audience and maximizing search visibility. Start by specifying the type of property, highlighting unique features like location, architecture, history, and amenities that can increase buyer interest and property value. Incorporate relevant keywords throughout your article, including brand names of high-end appliances and materials, the architect or builder’s name, and the property’s proximity to landmark locations or desirable community features. Additionally, identify your target market and tailor your content to their specific interests and needs. Offer strategies and tips for sellers, such as staging the property, pricing strategies, professional photography, and utilizing online platforms or real estate agents for wider exposure. Finally, touch on the legal and financial considerations involved in property transactions, such as tax implications, closing costs, and inspection contingencies. By following these tips and tricks, you can effectively sell your investment property and ensure a successful transaction.

Determining Market Value

When selling a commercial investment property, it is essential to start by determining its market value. Researching recent sales data and market trends can provide valuable insights into the current market conditions and help you establish a competitive asking price. Additionally, considering hiring a professional appraiser can provide an expert opinion on the property’s value and ensure accuracy.

Another crucial aspect to evaluate is the property’s income potential. Understanding the potential rental income or profits that can be generated from the property can help attract potential buyers, especially those interested in investment properties. Factors such as location, market demand, and property condition can all influence its income potential.

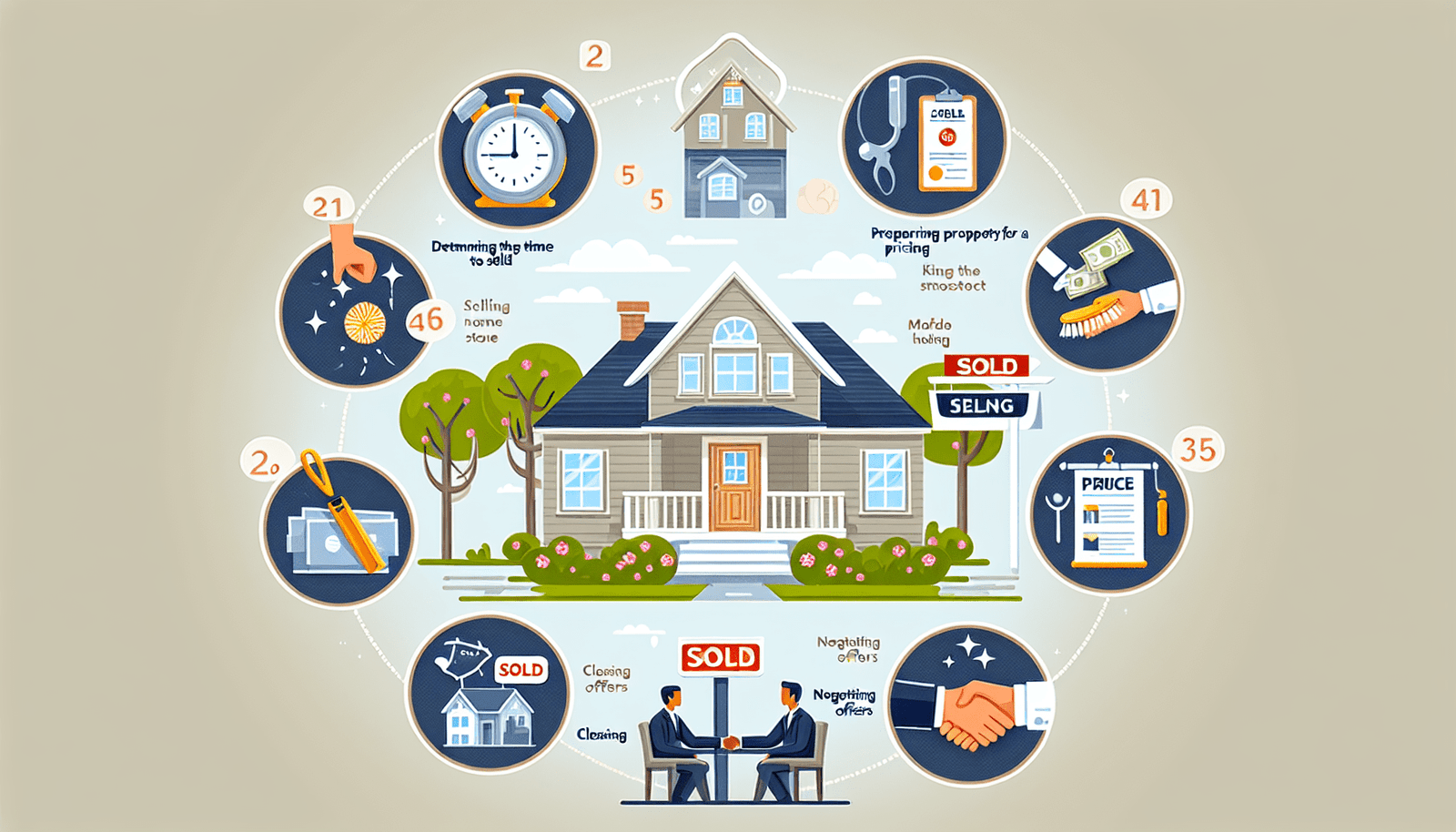

Preparing the Property

To make your commercial investment property more appealing to potential buyers, it is essential to invest time and effort into preparing the property. Start by cleaning and decluttering the property to create a clean and inviting atmosphere. A well-maintained property is more likely to attract interest from buyers.

In addition to cleanliness, consider making any necessary repairs or updates to enhance the property’s condition and appeal. Address any structural issues, update outdated fixtures, or refresh the property’s aesthetics to ensure it presents well to potential buyers.

Staging the property can also be a valuable step in showcasing its potential. By strategically arranging furniture and decor, you can help buyers visualize themselves in the space and highlight its key features. Professional staging services can be worth considering for optimal results.

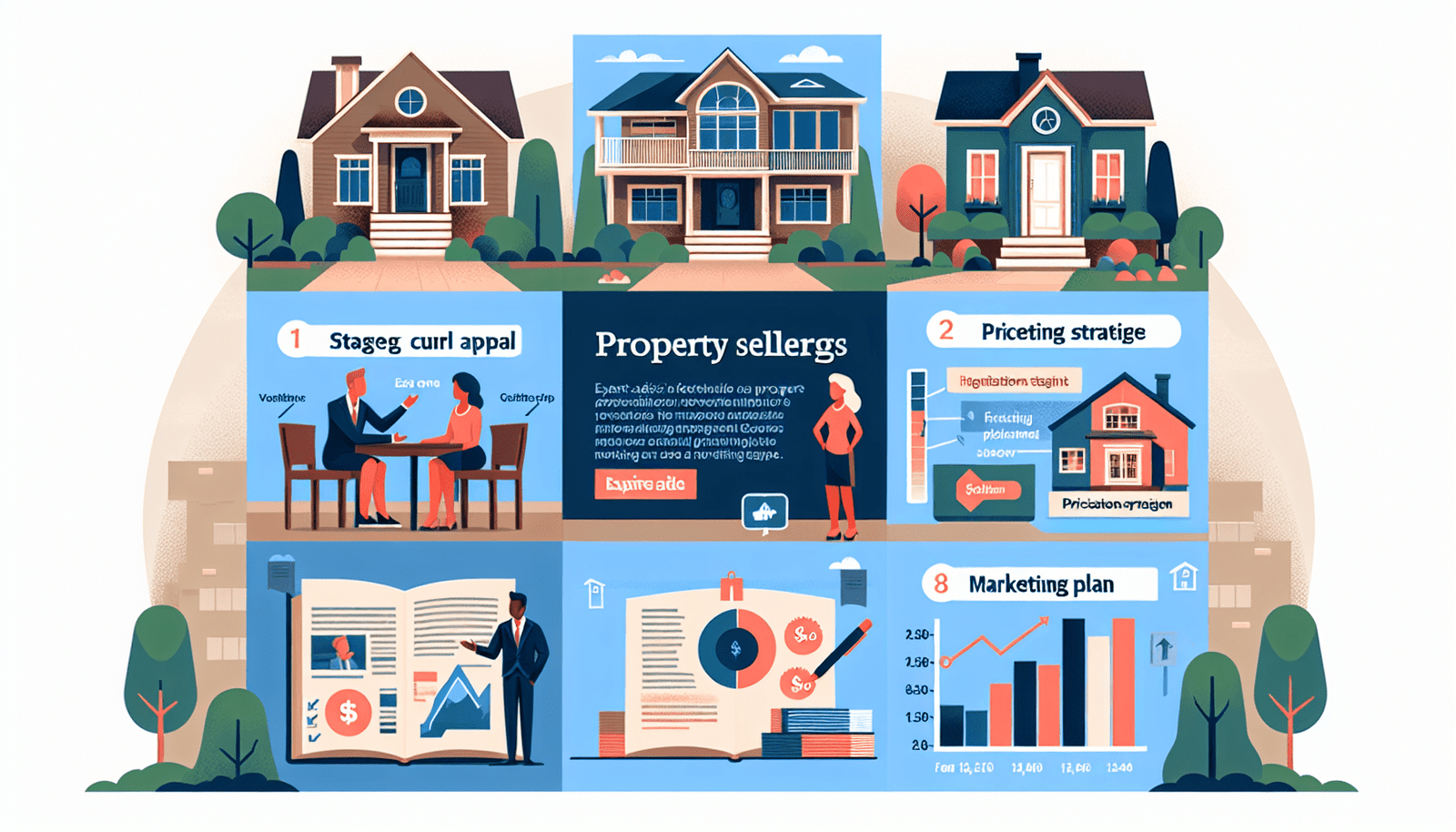

Marketing Strategies

To effectively market your commercial investment property, it is crucial to employ various strategies that will reach a wide range of potential buyers.

Creating compelling listing descriptions and photographs is essential to grab the attention of potential buyers. Highlight the property’s unique features, such as its location, amenities, and architectural details. Use descriptive language that paints a vivid picture and entices buyers to learn more.

Utilizing online listing platforms, such as real estate websites and social media, can significantly expand your property’s exposure. These platforms allow you to reach a larger audience and attract buyers from different locations. Additionally, partnering with real estate agents who specialize in commercial properties can provide access to their network and expertise in reaching qualified buyers.

Consider targeted advertising campaigns to reach specific groups of potential buyers. For example, if your property is ideal for a particular industry, advertising in industry-specific publications or online platforms can help you connect with the right buyers.

Identifying Potential Buyers

Defining the target market for your commercial investment property is vital to tailor your marketing efforts effectively. Consider the type of property, its location, and its unique features to identify the most likely buyers. Are you targeting small business owners, corporate investors, or developers? Understanding your target market enables you to refine your marketing strategy and speak directly to their needs and interests.

Developing a marketing strategy that resonates with potential buyers is essential. Craft your messaging and communication channels to align with their preferences. For example, if your target audience is Millennials, focus on digital platforms and social media. If targeting executives, consider traditional print media and industry-specific publications.

Utilize social media and networking to expand your reach. Engage with relevant industry groups, join online forums, and connect with professionals in related fields. Building relationships and establishing yourself as a knowledgeable resource can lead to valuable connections and potential buyers.

Negotiating the Sale

When you receive offers for your commercial investment property, it is essential to negotiate terms that work in your favor. Start by setting an appropriate asking price based on market research and the property’s value. Consider factors such as comparable sales, property condition, and income potential when determining your asking price.

When responding to offers, evaluate the terms and conditions carefully. Negotiate with potential buyers to find a mutually beneficial agreement. This may include price adjustments, timing considerations, or contingencies.

Consider hiring a real estate attorney to guide you through the negotiation process and ensure that the legal aspects of the sale are handled correctly. They can provide valuable guidance and ensure that your interests are protected.

Financial Considerations

Before finalizing the sale of your commercial investment property, it is crucial to consider the financial implications. Understand the tax implications of selling commercial properties, including potential capital gains taxes. Consult with a tax professional to ensure you are aware of any tax obligations and to explore strategies to minimize your tax liability.

Calculate potential closing costs associated with the sale, such as real estate agent commissions, legal fees, and any outstanding liabilities on the property. These costs can impact your bottom line, so it’s important to account for them when determining your desired sale price.

Consider financing options for potential buyers. Offering seller financing or partnering with lenders who specialize in commercial properties can attract buyers who may not have immediate access to the necessary funds. This flexibility can make your property more attractive and increase your chances of closing a successful sale.

Legal Requirements

Selling a commercial investment property involves various legal requirements that must be addressed. Start by obtaining any necessary permits and licenses for the sale. Local regulations may require specific documentation or inspections before proceeding with the transaction. Ensure you are in compliance with all applicable laws to avoid delays or legal issues.

Property disclosure laws require you to provide potential buyers with accurate and complete information about the property’s condition and any known issues. Be prepared to disclose any material defects or potential risks associated with the property. Failure to disclose relevant information can lead to legal consequences and damage your reputation as a seller.

Understand zoning and land use regulations that may impact the property’s future use. Familiarize yourself with any restrictions or limitations imposed by local authorities to ensure that potential buyers are aware of these factors.

Due Diligence

During the sale process, it is crucial to conduct due diligence to ensure that all relevant information about the property is gathered and addressed. Gather all relevant property documents, including titles, deeds, and surveys. These documents provide essential information about the property’s ownership and boundaries.

Conduct property inspections to identify any issues that may affect the sale or pose a risk to the buyer. Address any necessary repairs or issues promptly to avoid potential complications later in the process. If the property has tenants, review lease agreements and rental income to ensure a smooth transition for the buyer.

Thorough due diligence ensures that both you and the buyer have a clear understanding of the property’s condition and any associated risks or obligations.

Closing the Sale

As the sale nears its conclusion, it is important to coordinate with buyers, agents, and attorneys to facilitate a smooth closing process. Ensure that all required documents and paperwork are prepared accurately and in a timely manner. This includes transfer documents, financial agreements, and any necessary disclosures.

Facilitate the transfer of ownership and funds according to the agreed-upon terms. Coordinate with all parties involved to ensure a seamless closing experience. Clear communication and cooperation are key to a successful transaction.

Post-Sale Considerations

After the sale of your commercial investment property, there are several post-sale considerations to address. Close any remaining accounts and utilities associated with the property to prevent any unnecessary costs or confusion.

Provide the necessary documentation to the new owners or tenants, including keys, leases, and any relevant contact information. Ensure that they have all the information they need to take over the property seamlessly.

If the property has tenants, make sure they are informed of the change in ownership and any necessary steps they need to take. Aim for a smooth transition to maintain a positive relationship with the tenants and uphold your reputation as a responsible seller.

By addressing these post-sale considerations, you can complete the transaction successfully and leave all parties satisfied with the outcome.